The entertainment complex offers a variety of recreational services and activities such as a car racing track, haunted house, bowling alley, and video games. It targets children and youth across different age groups.

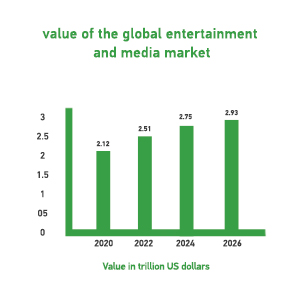

Feasibility studies provided by Mashroo3k Consulting Company help identify the Qatari market’s demand for the entertainment services offered by the complex, analyze customer preferences and how to meet them with the highest quality, and propose innovative solutions to enhance the project’s competitive advantages—ultimately aiming to achieve the best return on investment and optimal payback period.