The Healthcare Sector in the GCC Countries

Mashroo3k Consulting presents key indicators and insights for anyone interested in investing in this vital sector and its projects across the GCC region:

-

The total number of hospitals in the GCC countries is 802, according to the latest statistics. The public sector accounts for 58.9% of these hospitals, while the private sector holds 41.1%.

-

Over 61% of physicians are based in the Kingdom of Saudi Arabia.

-

Among GCC countries, the United Arab Emirates recorded the highest percentage of physicians working in the private sector at 64%, followed by Bahrain at 44.8%, and Qatar in third place with 27.1%.

-

Kuwait recorded the highest percentage of physicians in the public sector at 79%, followed by Oman with 74.6%, and Saudi Arabia with 71.6%.

-

In Saudi Arabia, annual spending on digital health infrastructure is expected to increase from $0.5 billion to $1.5 billion by 2030.

-

The GCC region currently has around 700 healthcare projects at various stages of development, valued at approximately $60.9 billion. These projects include hospitals, clinics, and research centers, with 264 projects worth $24.7 billion currently under construction.

Throughout its journey supporting entrepreneurs and investors, Mashroo3k Consulting has developed a strong belief in the importance of the healthcare sector and its crucial role in economic development and national progress. Based on this belief, the company has decided to present some essential indicators and investment keys for those looking to enter this sector in the GCC region:

-

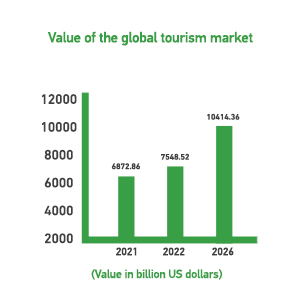

Healthcare expenditures in the GCC are expected to reach $104.6 billion in 2022, up from $76.1 billion in 2017.

-

Average healthcare inflation in the GCC is projected to decrease to 4% in the coming years.

-

In light of the expected increase in patient numbers, the GCC countries will need a combined hospital bed capacity of approximately 118,295 beds.

-

Artificial intelligence (AI) is expected to represent 30% of hospital investments in the GCC from 2023 through 2030.

-

The pharmaceutical manufacturing market in the GCC is expected to grow to a value between $8 and $10 billion.

-

The medical consumables manufacturing market in the GCC is set to flourish between 2025 and 2030, with a projected market size reaching $30 billion.