The feasibility study for a kindergarten project aims to analyze the economic and operational feasibility of establishing a specialized kindergarten that provides educational and care services for children aged 3 to 6 years. The study begins by selecting a strategic location in a safe, densely populated residential area to ensure easy access and increased demand for the kindergarten’s services. The study includes an analysis of the local market to assess the level of competition and develop effective marketing strategies and attractive pricing plans aimed at attracting parents and motivating them to enroll their children. It also includes estimating the financial costs of the project, starting with rental expenses and basic equipment such as educational furniture and facilities, all the way to salaries and operating expenses. The study focuses on designing integrated educational programs that support children’s mental and social development, while selecting a qualified teaching team trained in the latest interactive education methods.

A kindergarten project is considered one of the promising investments in the education sector, where its success largely depends on preparing a comprehensive and accurate feasibility study. The project aims to meet the needs of families seeking high-quality early childhood education for their children by offering advanced educational curricula focused on learning through play, teaching values and principles, and fostering creativity and innovation in children. The children’s education is overseen by a team of experienced teachers, ensuring comprehensive care and proper guidance for each child.

It is worth mentioning that the kindergarten has an attractive design and spacious areas that allow children the freedom to move and play in a healthy and safe environment, equipped with modern facilities and interactive learning tools that support the learning process. Additionally, the kindergarten places special emphasis on developing language and communication skills through group activities, interactive conversations, and providing support programs for children with special needs to ensure inclusive education.

It is essential to emphasize that the project seeks to provide a complete educational experience that prepares children for primary school successfully and fosters a love for learning and exploration from an early age. Undoubtedly, investing in this project is both valuable and beneficial for families and society.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Education Sector in GCC Countries

Because “Mashroo3k” Economic Consulting and Market Research Company believes in the importance of the education sector and its role in localizing national labor, it presents below the key indicators of the educational sector in GCC countries, thereby encouraging investment in this vital sector:

The total number of students in the Early Childhood Development stage (including nurseries and kindergartens) in GCC countries, according to the latest available statistics, reached 851.5 thousand students.

The number of school education students in the GCC was estimated at 9.3 million students (79.4% in the public sector and 20.6% in the private sector).

The number of adult education center learners was estimated at 181,247 students.

The number of higher education students was 2,206,446 students.

The number of early childhood education teachers was 50,647 teachers.

The number of school education teachers was estimated at 727,904 teachers.

There are 5,806 educational institutions operating at the early childhood stage.

There are 32,310 educational institutions operating at the school education stage.

Over the past years, governments in GCC countries have sought to bridge the gap between education and the labor market. They have adopted curricula that increase the share of vocational and technical education and encourage learning through modern media and technologies. It is also worth noting the increase in government spending by these six countries on education and its quality to graduate generations that meet the private sector’s labor needs.

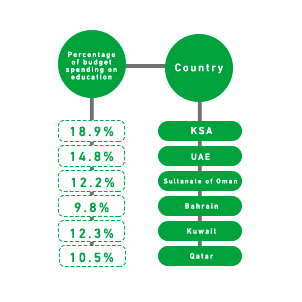

According to the latest statistics:

Saudi Arabia spends 18.9% of its budget on education.

The UAE spends 14.8%.

Oman spends 12.2%.

Bahrain spends 9.8%.

Kuwait spends 12.3%.

Qatar spends 10.5% of its budget on education.

By the year 2023, the value of the private education market in GCC countries is expected to reach $26.2 billion.

The Global Education Sector:

The size of the global educational services market reached approximately $2,882.52 billion by the end of 2021, and global experts expect it to reach $3,191.79 billion by the end of 2022 — achieving a compound annual growth rate (CAGR) of 10.7%.

By 2026, the market value is projected to increase to $4,623.90 billion, achieving a CAGR of 9.7% over the forecast period.

By 2030, the global value of education as an industry is expected to reach $10 trillion USD.

By 2024, the global online education market is projected to reach $247.46 billion USD.

The AI-powered education market is expected to expand at a compound annual growth rate (CAGR) of 36% from 2022 to 2030.

In the year 2000, the number of pupils worldwide was approximately 657 million, and this number increased to 739 million by 2019.

In 2000, the number of secondary education students was around 452 million, rising to 601 million by 2019.