mashroo3k Economic Consulting Company offers a feasibility study for a paper recycling plant project, with the highest return on investment and the best payback period. This study is based on a series of in-depth studies of the Qatar market size, an analysis of local and foreign competitors’ strategies, and the provision of competitive pricing.

The paper recycling plant recycles used and damaged paper waste using state-of-the-art machinery and equipment, producing new paper materials suitable for a variety of uses. The project targets a variety of institutions, including pharmacies, health centers, cleaning companies, clinics, and hospitals.

Experts at Mashroo3k Economic Consulting indicate that paper recycling plants are among the projects experiencing significant growth in Qatar, particularly in light of the country’s construction and infrastructure development policies, as well as environmental protection efforts aimed at protecting the environment from the damage caused by waste accumulation or incineration. Paper recycling projects contribute to reducing demand for raw materials, generating high economic returns, and reducing the unemployment rate, which has witnessed a significant increase in Qatar in recent years.

Mashroo3k Economic Consulting provides investors interested in investing in a paper recycling plant project in Qatar with a range of specialized feasibility studies based on up-to-date databases specific to the Qatar market. These studies help ensure the project’s success, achieve the highest return on investment, and provide the best payback period. These studies are conducted through in-depth studies of Qatar’s industrial sector, customer preferences, analysis of local and foreign competitor strategies, and the ability to provide competitive pricing.

Environmental conservation.

Contributing to meeting part of the growing demand for various types of tissue paper.

Creating new investment opportunities with good returns.

Achieving a good return for the project owner.

Achieving good returns, cash flows, and added economic value.

Optimizing the use of resources and assets.

Providing high-quality products.

Maintaining a price level that enables the project to achieve its target share.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The technological advancement witnessed by the Gulf Cooperation Council (GCC) countries—along with population growth—has led to an increase in waste generated from both human and industrial activities. This surge in waste has posed a significant challenge to GCC governments, urging them to address the issue swiftly to avoid environmental and health risks.

The total amount of waste generated in the GCC (both hazardous and non-hazardous) is estimated at approximately 131.8 million tons, with hazardous waste accounting for 1.2%, and non-hazardous waste making up 98.8%.

Mashroo3k Economic and Administrative Consulting presents the following key indicators for the recycling sector in the GCC:

Total hazardous waste collected in the GCC: 1.6 million tons.

Total non-hazardous waste collected: 130.2 million tons.

Hazardous waste is divided as follows:

6% medical waste

81.8% industrial waste

12.2% other types (e.g., batteries and electronic waste)

Non-hazardous waste is divided as follows:

40.7% construction waste

25% household waste

1.7% green waste

32.5% other types

51% (67.2 million tons) of total collected waste is treated.

Industrial waste collected in the GCC totals 1.3 million tons, with Saudi Arabia and the UAE accounting for 63.1% and 19.3% respectively of that amount.

Household non-hazardous waste collected in the GCC amounts to 32 million tons.

The UAE ranks first in the amount of waste recycled, with a share of 42.8%.

100,000 tons of hazardous waste (or 9.3%) is recycled.

Saudi Arabia leads in solid waste volume, generating over 16 million tons annually, followed by the UAE with 5.4 million tons.

Food and green waste: 58%

Glass: 3%

Metals: 3%

Paper and cardboard: 13%

Plastic: 12%

Wood: 1%

Rubber and leather: 2%

Other waste: 8%

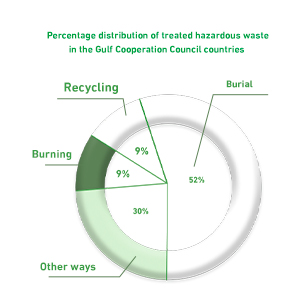

Hazardous Waste:

Incineration: 9%

Landfilling: 51.7%

Recycling: 9.3%

Other methods: 30%

Non-Hazardous Waste:

Landfilling: 51%

Other methods (e.g., incineration, recycling): 49%

Reducing primary energy consumption by about 4%

Creating 50,000 jobs in the recycling sector

Cutting CO₂ emissions by 13 million tons annually

Contributing $138 billion USD to GCC economies between 2020 and 2030

Mashroo3k recommends investing in the recycling sector for the following reasons:

The world produces approximately 2.01 billion tons of municipal solid waste annually, expected to rise to 3.40 billion tons by 2050.

In 2014, the global output of electronic waste reached 12.8 million metric tons, increasing to 53.6 million metric tons by 2019.

Plastic and paper account for around 29% of total global waste, making them promising sectors for profitable recycling investment.

Mashroo3k Economic Consulting affirms that the volume of waste in Saudi Arabia now exceeds 45 million tons annually. With the Kingdom’s commitment to raising the recycling rate from 1% to 80% by 2035, the company sees investment in this vital sector as highly profitable. Regarding the future of recycling and energy generation, the following prospects can be highlighted:

In Saudi Arabia, 45,000 terajoules of energy could be saved annually just by recycling glass and metals.

An estimated 3 terawatt-hours of electricity could be generated every year by utilizing all food waste through biogas facilities in the Kingdom.

Additionally, 1 to 1.6 terawatt-hours of electricity per year could be produced by processing plastic and other mixed waste—such as paper, cardboard, wood, textiles, leather, etc.—using pyrolysis technologies.

Mashroo3k emphasizes that recycling is one of the most promising sectors in the Kingdom, and projects in this area represent genuine investment opportunities, especially as Saudi Arabia moves toward a green economy. Environmental protection has become a key priority for the country’s leadership, clearly reflected in Vision 2030.

The global waste management market was valued at approximately USD 989.20 billion in 2021, and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030, reaching USD 1,685.5 billion by the end of the forecast period.

The Middle East and North Africa (MENA) region is expected to experience a CAGR of 6.3% in recycling and waste management between 2022 and 2030. This growth is driven by increased awareness of the sustainable benefits of waste reuse and recycling.