mashroo3kConsulting Company offers a feasibility study for a plastic bag factory project in Qatar, with the highest return on investment and the best payback period. This study is based on a series of in-depth studies of the Qatari market size, an analysis of competitor strategies, and parental preferences, all within the framework of the growing education sector in Qatar.

The plastic bag factory offers a variety of products for clothing and food packaging, such as garbage and medical waste bags, stretch rolls, and plastic sheeting. The plastic bag factory targets wholesale and retail household goods retailers and shopping malls. For investors interested in investing in a plastic bag factory project for various educational levels in Qatar, Mashroo3k Consulting provides a set of specialized feasibility studies based on updated databases specific to the Qatari market. This helps ensure the project’s success, achieves the highest return on investment, and offers the best payback period.

Products that meet international quality standards.

Latest manufacturing and packaging technology.

A creative and innovative marketing team.

A management team with ambitious plans.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Plastics Sector in the GCC

In 2020, the global plastics market was estimated at approximately $579.7 billion and is expected to reach $750.1 billion by 2028, at a compound annual growth rate (CAGR) of 3.4%. In the GCC region, the plastics industry has grown in recent decades, driven by governments’ desire to diversify their economies and move away from relying on oil and gas as the sole sources of income. The rising demand for plastics in certain industries, such as automotive, packaging, construction, and water pipes, has also been a driving force behind the growth of this vital industry. A report by the Gulf Petrochemicals and Chemicals Association (GPCA) stated that plastics is the second largest industrial sector in the region, with products valued at $108 billion. For those interested in exploring the industry’s indicators in the Kingdom of Saudi Arabia, Mashroo3k will present specific points that can serve as a guide on your investment journey. According to our latest available statistics:

Saudi Arabia accounts for approximately 72% of the Gulf’s plastics production and industries, while the Gulf region as a whole accounts for 9% of the global plastics industry.

Saudi Arabia ranks eighth globally in plastics production and holds 2% of global polymer production.

By the end of the second quarter of 2021, there were more than 222 rubber and plastics factories in Saudi Arabia, representing 11.9% of the total number of factories operating in the Kingdom.

According to the Standard International Trade Classification, the Kingdom’s exports in the “Plastics in Primary Forms” category amounted to SAR 67,824,000,000. The weight of these plastics was estimated at approximately 16,978 tons. For the “Plastics in Non-Primary Forms” category, the value of these exports was estimated at SAR 2,403,000,000, and the weight of these plastics was 384 tons. In the second quarter of 2020, commodity exports of plastics, rubber, and their products were estimated at approximately SAR 13,723,000,000. This figure increased to SAR 22,491,000,000 in the second quarter of 2021.

Operating expenses for rubber and plastics product manufacturing activities now exceed SAR 10,103,147,000, while total revenues for these activities reached SAR 20,148,798,000.

Operating expenses for rubber and plastics product manufacturing activities are expected to rise to SAR 20,264,052,000 in 2027, and operating revenues for these activities are expected to rise to SAR 32,477,785,000 in the same year (2027). This represents a growth rate of 8% for these activities’ expenses, and a growth rate of 5.4% for revenues.

Finally, Mashroo3k confirms that global demand for plastic will triple by 2050. Available data indicates that plastic consumption among individuals in the Gulf Cooperation Council (GCC) countries is on the rise, with per capita plastic consumption estimated at 94 kg/year, according to the latest available statistics.

According to the Organization for Economic Co-operation and Development (OECD), total global plastics production reached 234 million metric tons in 2000, and this figure has risen to 460 million metric tons. This represents a significant growth in the sector’s production. Therefore, Mashroo3k recommends investing in this sector, especially since global plastic waste has increased from 156 million metric tons in 2000 to 353 million metric tons in 2019.

The Global Plastics Sector

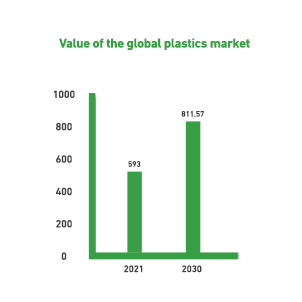

The global plastics market was valued at $593 billion in 2021, and by the end of 2022, the market is expected to reach $609.01 billion. The market will expand at a compound annual growth rate of 3.7%, reaching a value of approximately $811.57 billion by the end of 2030.